Accounting AoL Process, Learning Goals, and Assessment

Accounting Programs Assurance of Learning (AoL) Process

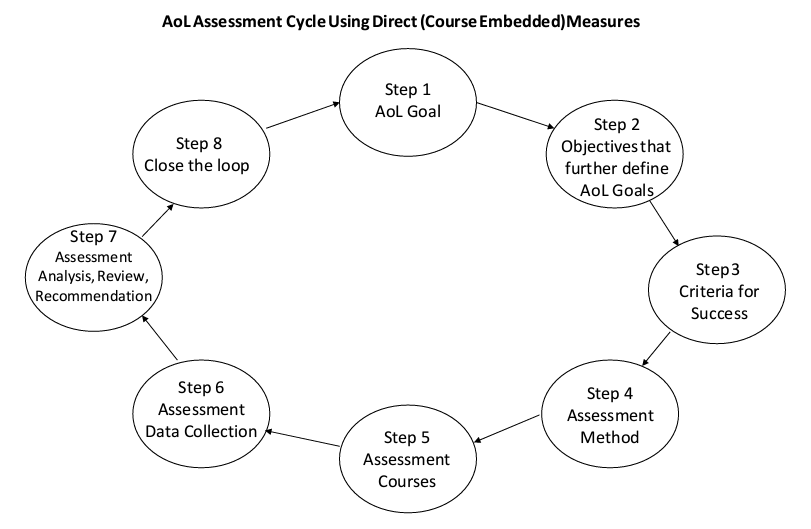

The AoL process is systematic and well documented for both accounting programs (BSBA Accounting Specialization program and the Master of Accountancy graduate program). The AoL assessment cycle using direct course embedded and indirect measures is as shown below (identical to the BSBA AoL process used by the college of business).

In Step 1, the learning goals are identified by the specific department faculty curriculum coordinator using feedback from the accounting advisor boards (one for the graduate program and one for the undergraduate program). In 2017, the Master of accountancy learning goals were created, separate from the learning goals for the undergraduate program. The undergraduate program learning goals were not changed at that time. The department is currently in the process of a curriculum revision at the undergraduate level and the learning goals will be revised in the coming year.

In Step 2, each learning goal is further divided into specific learning outcomes (objectives). These sets of learning goals are discussed and approved by the entire department faculty.

The next steps (Step 3, 4, and 5) center around an assessment plan where the assessment criteria and methods are selected and which courses in the programs introduce, reinforce, and assess each individual learning goal.

The Assessment Data Collection occurs next using course-embedded measures in most cases or using external source such Beta Alpha Psi organization, the Business Career Accelerator, and ALEKS assessment tool (Step 6). The summary reports are analyzed and distributed to the entire faculty for review (Step 7). Faculty discuss the result at department meetings and provide feedback and useful information to improve the student learning in specific course or to make changes in the assessment method deemed necessary. This final step constitutes what is referred to as “closing the loop” process (Step 8)

BSBA Accounting Specialization Program Learning Goals

Goal 1: Students will apply the conceptual foundation, generally accepted accounting principles, and cost principles to the analysis of business transactions.

Outcomes: Students will -

a. appropriately record transactions in an accounting system

b. prepare financial statements and reports by completing an accounting practice set, project, or cases.

Goal 2: Given an accounting decision situation, students will think critically about the accounting issues.

Outcomes: Students will -

a. clearly state the problem

b. identify alternative courses of action

c. determine relevant information needs

Goal 3: Given an accounting decision situation and a set of information needs, students will effectively perform the decision-making process.

Outcomes: Students will -

a. locate and apply appropriate information

b. formulate a recommended course of action

c. effectively communicate that recommendation

Goal 4: Students will demonstrate an understanding of the importance of professional activity to their careers and to their continued learning.

Outcomes: Students will engage in one or more of the following activities -

a. actively participating in student chapters of accounting organizations

b. attending professional meetings

c. utilizing the services of the Business Career Accelerator

d. completing an internship in an accounting environment

e. engaging in professionally-related community service

f. assisting in faculty research

Goal 5: Students will demonstrate an awareness of current events affecting the Accounting profession and the relevance of the events to the profession.

Outcomes: Students will -

a. present evidence of maintaining a regular reading program of current business newspapers, other periodical publications, or appropriate electronic information sources

Master of Accountancy Learning Goals

Goal 1: Students will demonstrate their knowledge of the practice of accounting

Outcomes: Students will -

a. identify the appropriate accounting principles to be used for a specific accounting transaction

b. apply the principles identified to determine their effect on the financial position, cash flows, and / or the results of operation of the entity and select the most appropriate accounting treatment among the alternatives

c. based on those results, record the transaction in the accounting system

Goal 2: Students will think critically about complex accounting, professional, and ethical issues

Outcomes: Students will -

a. determine the relevant information needs

b. gather all of the pertinent facts and clearly stating the problem

c. identify alternative courses of action

d. recommend a course of action based on supported reasoning

Goal 3: Students will effectively communicate issues, analysis, and recommendations

Outcomes: Students will -

a. demonstrate effective writing skills

b. demonstrate presentation skills

c. demonstrate team collaboration

Goal 4: Students will provide evidence of an awareness of the relevance of accounting information systems and information technology auditing, system risks and control processes

Outcomes: Students will -

a. demonstrate an understanding of the methods used by auditors to assess risks and to identify controls to mitigate these risks

b. demonstrate an understanding of privacy and security concerns relating to information systems

c. demonstrate an understanding of IT security controls and the impact of these controls on the overall reliability of accounting information systems

Goal 5: Students will be able to analyze data in traditional and Big Data sources

Outcomes: Students will demonstrate the ability to -

a. use analytical software to uncover patterns in accounting and other data

b. use statistical techniques and other methods to uncover patterns in accounting and other data

c. use visualization software to professionally present findings

d. question the limitations of uncovered patterns and findings

Assessment of BSBA Accounting Specialization Learning Goals

Assessment of Learning Goal 1 (accounting knowledge)

BGSU accounting specialization students are required to use ALEKS every semester beginning with Acct 3210 Intermediate Accounting I. Students must achieve proficiency in 85% of all ALEKS financial accounting topics. Each assessment course begins with an “Initial Assessment.” In the initial assessment, ALEKS will determine which topics the student knows and which topics need additional practice.

Closing the Loop

In Acct 3210, the initial assessment in ALEKS is performed during the first week of class. This allows for more of a “real-time” evaluation of what students are learning and whether topic coverage needs to be adjusted. Evidence that this process is working can be seen by the Final Assessment percentages. The instructors of the upper-level accounting courses (Acct 4220, Acct 4510, and Acct 4600) are very pleased with the use of ALEKS as it provides a way to make sure all the students still master the basics of accounting concepts before they start learning more advanced features. At least 75% of the students reach the 85% proficiency at the beginning of the semester and more than 80% at the end of the semester.

Assessment of Learning Goal 2 (critical thinking) and Learning Goal 3 (problem solving & communication skills)

These skills are assessed in the senior-level accounting course Acct 4600 AIS. The students are required to complete a security case project where they will apply problem solving and communication skills.

Closing the Loop

All students were deemed to have met the expectation and no attempt has been made to move beyond the dichotomous categorization of meet/did not meet. In Fall 2017, 68% of the students completed the project. The reason for the low percentage of completion is due to the fact that the project was due at the end of the semester. Many students were not penalized for not completing it. That was changed in the next semester where the project was assigned earlier.

Assessment of Learning Goal 4 (professionalism/career development)

| Learning Goal Assessed | Method/Course Where Assessed | Satisfactory Performance | Observations of Student Performance |

| 4a, 4b, 4d | Membership in Beta Alpha Psi | not specified | # Students 2016 2017 2018 Participating 37 39 40 |

| 4c | Data from Placement Office | not specified | 2015 2016 2017 Grad Class Report # Completed 115 84 90 |

Closing the Loop

Student participation in Beta Alpha Psi (undergraduate and graduate) increased significantly in the past year, suggesting recruiting/marketing efforts are working. Meaningful participation in professional / community service activities is expected. For quality, our Beta Alpha Psi chapter’s consecutive “Superior Chapter Status.”

Assessment of Learning Goal 5 (awareness of current events) and Learning Goal 3 (decision-making)

The reading program requires a total of five to eight articles be selected and reported on during the semester in Acct 3410 (Individual Income Tax). In F 2016, students were required to find and summarize five articles. In F 2017. At the midpoint of term, instructor had students submit four articles, do a two-paragraph summary of each.

Closing the Loop

The implemented changes do not seem to have a considerable impact on student performance. The instructor admits to have implemented a more rigorous grading system during the second year. The instructor is committed to improve the system by presenting some recurring mistakes in writing and provide the students with samples of submissions that received 100% correctness.

Assessments for Master of Accountancy Learning Goals

Assessments for Learning Goals 1 (accounting knowledge) and Learning Goal 2 (problem solving)

One of the tools used to measure learning objectives one and two was a section of a test required in Acct 6510. Students were required to answer three questions listed below based on a provided flowchart.

Closing the Loop

The results indicate the majority of students meet or exceed the expectations for both learning objective one and two, however, the results vary based on the complexity of the question. It is clear that, in general, these two learning objectives need to continue to be a focus of our curriculum. Regarding written communication skills, a majority of the students are performing at or above expectations with room for improvement.

Assessments for Learning Goal 3b (oral communication)

Improving student performance on the oral communication skills involved two courses in back-to-back semesters. In Fall 2017, data was collected on student presentations in Acct 6730 and the same data was collected in Spring 2018 in Acct 6600 Business Intelligence and Data Analytics. A score for each category was determined for each student in each class. The instructor for Acct 6600 recorded presentation data during the fall Acct 6730 course.

Closing the Loop

After the spring semester the Acct 6600 professor and 6730 met to discuss the results and share ideas about how to raise presentation performance going forward. It was decided that organization, content, and audience engagement were most important to focus on in the fall 2018 6730 course.

Assessment for Learning Goal 3c (team collaboration)

During Fall 2017 semester, in Acct 6730 (Ethical Obligations of Accountants), 12 teams were formed at the beginning of the semester. The teams did three small case presentations during the semester and then a larger final presentation and project at the end of the semester. Team members ranked each other based on quality of work, quantity of work, creativity, reliability and teamwork.

Closing the Loop

The following are the recommendations for Fall 2018 cohort: (1) At the beginning of the semester, communicate the team collaboration expectations to students and what they will grade each other on in this category; (2) At the midpoint of the semester, use the matrix or a similar tool to assess how the teams are doing and identify any problem areas to address individually.

Assessments for Learning Goal 4 (risks and controls)

In Acct 6550 class, students complete a SAP project. The objective of this project is for students to become familiar with the steps and the documents involved in a typical purchasing transaction and also investigate how the SAP system is set up and operates for this type of transaction. In addition to the understanding of business processes, students are also required to properly identify specific internal controls involved at stages of the system.

Closing the Loop

To improve the performance in the SAP project administered during fall semester of the master program, the Acct 6550 instructor will emphasize more on the importance of internal controls in enterprise-wide business software.

Assessments for Learning Goal 5 (data analytics)

Data Analytics concepts are introduced, reinforced and assessed in two required courses (Acct 5560, 6600). One third of the Acct 5560 course is dedicated to these concepts. At the end of the data analytics module of Acct 5560, students are required to complete a comprehensive data analytics test where the students use ACL generalized audit software and SQL queries to answer specific audit questions.

Closing the Loop

The results are very encouraging. They show that students in the Master program at BGSU are well-prepared to be competitive in the job market by building their resume in data analytics skill.

Updated: 10/21/2022 04:13PM