A MESSAGE FROM THE CHAIR

2021 SPRING DEPARTMENT OF FINANCE NEWSLETTER

Chair’s Message

Greetings from the Department of Finance! We hope all has been going well in this unprecedented COVID-19 pandemic. We are pleased to share news and stories of the past year through 2021 Department of Finance Newsletter.

We completed move-ins to the new College of Business building, Maurer Center, during the month of last August, and the College of Business is now officially named as “Allen W. and Carol M. Schmidthorst College of Business” with a transformational naming gift. This academic year, our classes have been offered in one of three delivery modes, in person/hybrid, remote, and online (web-based) by strictly following CDC and university safety guidelines and protocols.

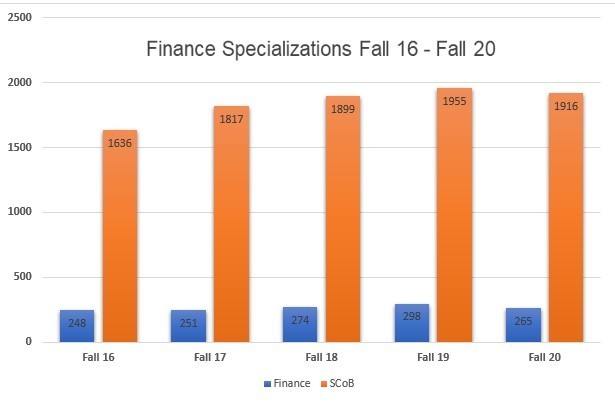

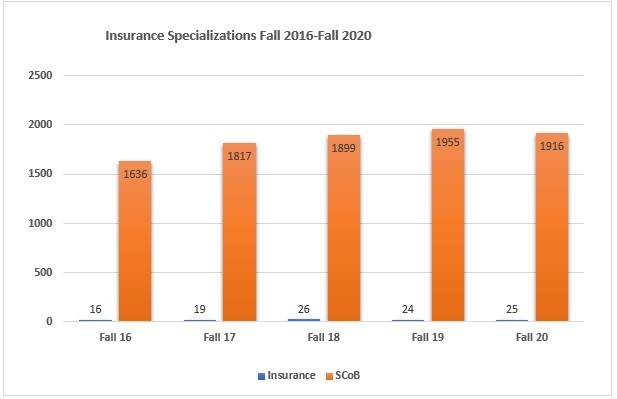

While the overall university enrollment increased and hit a record high this fall, it was mainly due to the exponential increase in the online MBA program. Similarly to the university, the undergraduate enrollment for Schmidthorst College of Business was down to 1916 this fall from 1955 last fall.

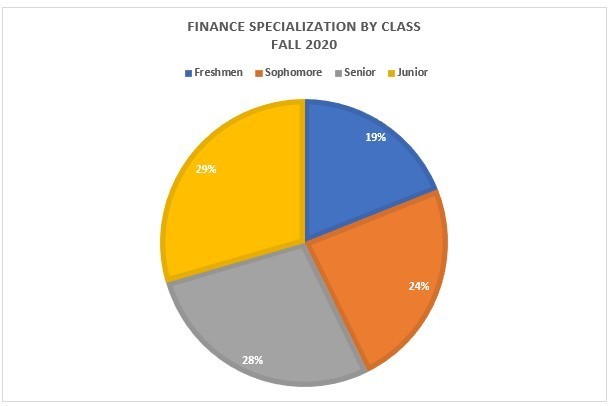

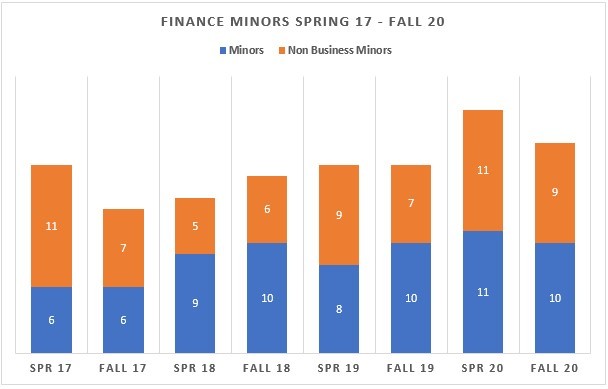

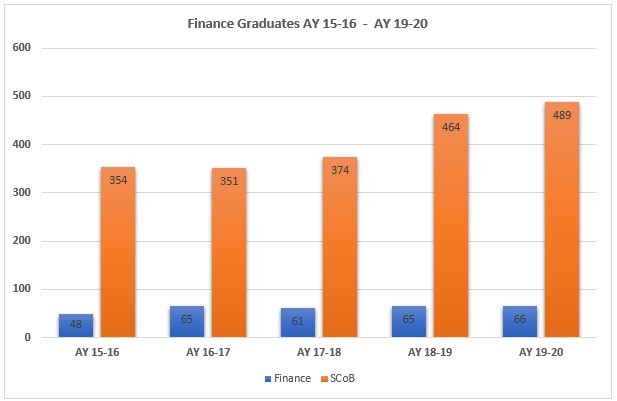

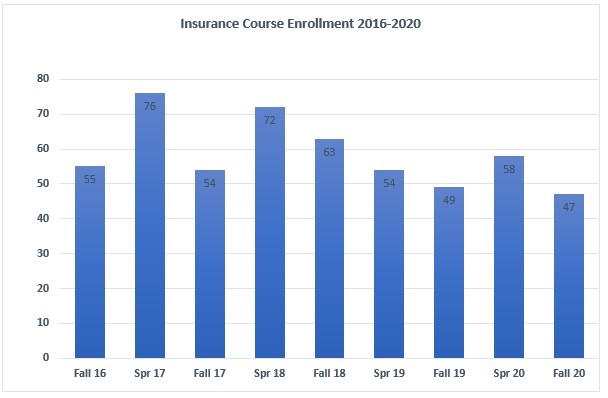

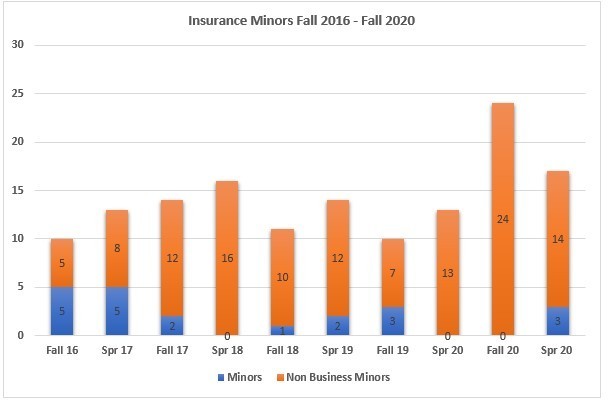

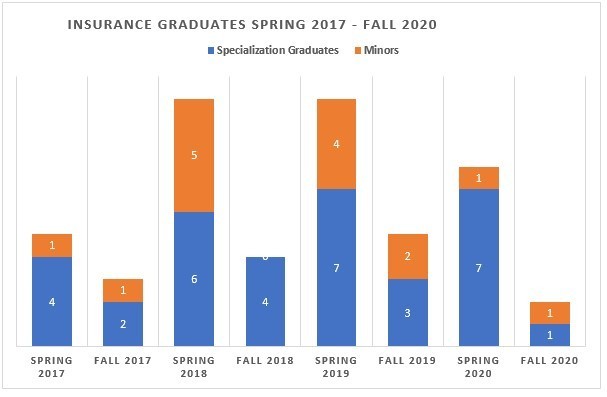

We finally had a “break” this past fall in the unstoppable growth of our Finance program over the last decade. The Finance program had a total of 284, consisting of 265 in Finance Specialization (down from 298 last fall) and 19 in Finance Minor (up from 18 last fall). The Insurance program had a total of 49, consisting of 25 in Insurance Specialization (up by 1 from last fall) and 24 Insurance Minor (up by 14 from last fall). During the last academic year, 66 and 13 Finance and Insurance program students graduated, respectively. The online MBA program, which started in Spring 2019, has enrollment of 385 in Spring 2021, of which 40-50 students are expected to concentrate in Finance.

Your continuing strong support led the Department to award $27,500 to 43 Finance students and $17,500 to 23 Insurance students in scholarships as well as two Graduating Senior Awards in Finance and Insurance, each with a plaque and $500 cash prize this past year. We thank all our donors deeply and wholeheartedly including Insurance & Risk Management Institute members, alumni, friends, and department colleagues for their support.

There was no change in department faculty during the past year. While the position of a full professor with Darwin B. Close Professorship was approved by the university in fall 2019, the hiring process has been on hold since last March due to the COVID-19 pandemic. The Department has recently submitted a new request of the same position for next fall. The Department have had a new administrative staff since last June; Holly Orlowski (hmorlow@bgsu.edu) replaced Kristin Forman. Dr. Liuling Liu was on FML this past fall, and is on Faculty Improvement Leave in Spring 2021.

Due to the pandemic, the Department was not able to hold many annual events such as Finance and Insurance Advisory Board joint meeting, Insurance & Risk Management Symposium, Insurance & Risk Management Institute Dinner, Graduating Senior Reception, and Finance Speaker Series. Hopefully, we can go back to normal or ‘new’ normal and engage fully in these events starting this fall.

We’d like to hear from you. Please share your stories of how and what you are doing in your career with our students and other alums. Simply email or fax the questionnaire at the end of the newsletter.

Although we are still in the challenging times, we are cautiously optimistic about days ahead and looking forward to a year of rebound and continuing progress. We invite you all to be a part of this endeavor.

Until our next communication, we wish you and your family to stay well, safe, and healthy.

Go Falcons!

Sung Bae, Chair

LET US HEAR FROM YOU

We enjoy hearing from our alumni. Please let us know what you have been doing, suggest information you would like for us to share and help us keep our mailing list up to date. If desired, you may enclose a donation to the Department with your submission.

WE DEPEND ON YOU

You may make a donation to the BGSU Foundation-Department of Finance. This is a tax deductible contribution. If your employer has a policy of matching employee gifts to universities, the amount contributed will double.

ENROLLMENT UPDATES

Spring 2020 and Fall 2020 Graduates Job Placements

Novogradac and Co LLP

Western and Southern Life

Nationwide

Medical Mutual of Ohio

Bendix

Bendix Commercial Vehicle Systems

Rehmann

21st Century Financial

STUDENT ACHIEVEMENT

Scholarship Information for 2020-2021 School Year

Finance awarded $27,500 in scholarships to 43 students. Scholarship winners are listed below:

| Avery Dennison Annual Scholarship | Joseph Lewis |

| John & Deborah Bowen Rising Junior Award | Sarah Kerr |

| Darwin B. Close Scholarship | Connor Ford; Bryanna Vanden Bosch |

| Mary Jane Little Dorais Scholarships in Finance | Maximus Denman; Hannah Sexton; Curtis Morbitzer; Justin Luoma |

| William H. & Muriel A. Fichthorn Scholarships | Rachel Long; Vince Manning; Emilee Davis; Tony Gossett; Austin Wilker; Christopher Sullivan; Harrison Dean; Samuel Flanders |

| Emery S. Gielow Scholarship | Ashley Schappacher; Jacob Wilhelm |

| J. Warren Hall Scholarships | Robert Howard |

| Kenneth H. Harger Scholarships | Spencer Kuess; Mitchell Knoth; Braxtyn Baldwin |

| Key Bank Scholarships | Jason Demland; Grace Blandin; Donovan Bland |

| Bruce and Janet Misamore Scholarships | Bailey Smith; Jessica Foster |

| North Star Scholarship | Janae Johnson |

| Thomas Pemberton Scholarships | Andrew Nedeljkovic; Connor Tumblin |

| Geoffrey & Linda Radbill Scholarships-Finance | Stephen Blanford; Alexis Noll; Gabriel Sayer; Caylee Rieman; Lauren Hehl-Myers; Megan Warburton; Kylie Stewart |

| Donald L. Speck Scholarships | Colton Stevens; Zachary Hoffman; Hogan Thomas |

| John & Inge Bowyer Book Awards | Devan Harmych; Ryan Johnston |

| Louis & Adelyne Klein Book Awards | Lindsey Itnyre; Lance Kern |

| Finance Faculty Book Awards | Joshua Auten |

Insurance awarded $17,500 in scholarships to 24 students. Scholarship winners are listed below:

| IRMI Charter Member Scholarships | Elene Kaufmann; Jacquelynne Deuley; Evan Kaufman; Kristina Fennell; Rachel Schnipke; Anna Gehring; Lugenia Glass; Paige Bachner; Shelby Crouse; Carolyn Smith; Cameron Kraeger; Julie Sollars; Preston Morman; Mitchell Fink; Emily Kuder |

| Geoffrey & Linda Radbill Scholarships-Insurance | Blake Anderson; Nikolas Geier; Allison Valente |

| RIMS Scholarships | Jordan Jensen; Joshua Becker; Benjamin Baldridge; Cameron Rufus; Anthony Russell; Kathryn O’Connell |

2020 Top Graduating Senior Honors

Two students were awarded the 2020 Top Graduating Senior Honors.

FINANCE – Paige Redlin

- Specialized in Finance and International Business

- Interned at Quicken Loans, Kem Tec Land Surveyors, and Macomb County Treasurers Office

- Studied Abroad in Nantes, Paris, and Brussels through Audiencia Business School

- Worked as a CoB Student Ambassador

- Served as President and VP of Recruitment of Women in Business Leadership

- Panelist at 2019 Women in Leadership Conference

- Served as a COB Peer Leader, Dean's Scholar, and Deans Advisory Council Member

- Currently pursuing a Full-Time MBA at Bowling Green State University

INSURANCE – Collin Reynolds

I interned with Modern Woodmen of America as a Financial Representative Intern one semester, and with Elmwood Local Schools in their Treasurer's Office as an intern for a semester. While at BGSU, I was a Campus Tour guide for 3.5 years, and worked in the Student Enrollment Communication Center for the Office of Admissions for 3 years. I was Vice President of Finance for Delta Sigma Pi for one year, and involved in the organization all four years. I was the Treasurer of Gamma Iota Sigma for one year, involved in the organization for two years. I specialized in Finance with a Concentration in Financial Planning, as well as Insurance.

- Specialized in Finance, as well as Insurance and Risk Management

- Interned both at Modern Woodmen of America and Elmwood Local Schools Treasurer's Office for one semester each

- Worked as a Campus Tour Guide and Student Caller at the Student Enrollment Communication Center

- Served as Vice President of Finance for Delta Sigma Pi and Treasurer of Gamma Iota Sigma

- Currently works at Westfield as a Property Claims Representative

Student Success Story

Two students, Mitchell Hogrefe and Gabriel Payne, participated in the Federal Reserve Bank of Cleveland (FRBC) Undergraduate Research Poster Competition on May 3, 2019. Mitchell Hogrefe won the first place in the Finance Division of competition. Mitchell’s project title was “The impact of student loans on post-graduate life”. Gabriel’s project title was “The impact of social capital on small business survival and success”. Two students’ research projects were under the guidance of Dr. Liuling Liu.

A Synopsis of Mitchell Hogrefe’s First-Place Project:

Student loans, as a progressively increasing portion of consumer debt, are becoming a concern to the society and economy. There is a growing awareness and interest among the public and policymakers of the important role student loans can play in the life of students after they graduate. Several existing studies examined the impact of student loans on home ownership and mortgage, and found inconsistent results. In this project, Mitchell proposes that post-graduate life consists of two major aspects: home purchasing and career development. He identifies that there is no study has investigated the impact of student loans on the career performance. In his empirical model, he regresses the firm productivity on the student loan per capita, controlling for various firm characteristics and firm-fixed effect. He finds that students with higher level of student loans have pressure to work harder and be more productive. The effect is more pronounced when the firm is riskier.

Student Managed Investment Fund (SMIF) Update

The BGSU Student Managed Investment Fund beat the market as part of FIN 4360/MBA 5610 – Portfolio Management taught and advised by Dr. Stephen Rush. Eight undergraduate students and 1 graduate student managed a long-only equity portfolio worth about $725,000. The goal of the class is to beat the S&P 500 index (a benchmark widely used in the investment management industry) by researching and presenting undervalued stocks as well as tactical asset allocation between industries. Each student must convince the other students of their investment idea in order to change the portfolio and the class must generate enough value in a single semester to outperform for the entire year. This semester was particularly challenging given the hybrid course format. The class used the new visualization lab in the Maurer Center to integrate in-person and remote presentations.

Over the 2020 calendar year, the fund returned 21.74% compared with a market return of 18.35%. The students beat the market with valuation skill rather than by taking on excess risk. The fund returned an alpha of 3.78% after accounting for risk. By comparison, an index fund has no alpha and most active managers have negative alpha after accounting for taxes and fees. The past year represents the continuation of excellent investment performance by previous classes. The portfolio has delivered a total of 51.95% over the past 3 years or approximately 1% higher than the market each year. The end of semester report has been useful for prior students getting jobs in the investment industry and this year’s performance will likely be even more beneficial.

Participating Students: Gayge Carroll; Travis Cring; Emilee Davis; Connor Ford; Janae Johnson; Carson Musser; Michael Ramirez; Marco Solis Hinojosa; Christopher Sullivan

Gamma Iota Sigma Update

(Written by Professor Roc Starks, GIS Faculty Advisor)

Gamma Iota Sigma activity has been somewhat limited due to the Covid 19 protocols here on campus. The chapter has been actively attending many virtual events hosted by the Gamma Iota Sigma Grand chapter, including virtual job fairs, networking opportunities and educational programming.

Our chapter is also participating in the Diversity, Equity and Inclusion efforts as part of the overall national Gamma Iota Sigma initiative.

Elene Kaufmann, from Fairview Park, Ohio, is serving as the Gamma Iota Sigma Chapter President for the 2021-2022 academic year.”

ACADEMIC UPDATE

New Course Information: FIN 4200 Financial Technology (Fintech) Innovations and Applications (3)

Course Description: This course is to introduce students to the fundamental building blocks of financial technologies (Fintech) with a focus on the application of Fintech using cases to understand how Fintech solves specific problems in financial markets. Topics may include innovations in payments, credit tech, crowdfunding, artificial intelligence and machine learning, robo-advising, blockchain, and cryptocurrency. Prerequisite: C or better in FIN 3000.

Course Rationale and Objective: In recent years, the financial industry has seen radical disruption and innovation, fueled by over $500 billion global investments in financial technology (Fintech). The demand for Fintech professionals who understand the technologies set (e.g. digital payment system, p2p lending, crowdfunding, artificial intelligence, machine learning, robo-advising, blockchain, and cryptocurrency) to shape the future of finance has never been higher. Therefore, it is crucial to develop Fintech education in order to prepare our Finance students at BGSU for the tech-driven workforce. This course is designed to introduce the fundamental building blocks of financial technologies. The course focuses on how FinTech solves specific problems in financial markets and the application of technologies using various cases. This course purports to provide an understanding of who new players are and how they have changed the way financial markets operate.

Instructor: Dr. Liuling Liu has just completed the 6-week Fintech online course sponsored by Harvard University. Through the training, she learnt innovative pedagogical approaches pioneered by the Harvard Business School and adapted the Case Method Approach, which should allow her to teach BGSU students real-life challenges that reflect the complex, dynamic nature of the FinTech landscape.

FACULTY UPDATE

Faculty Publications (2020 year)

- Bae, Sung C., Taek Ho Kwon, "Hedging Operating and Financing Risk with Financial Derivatives during the Global Financial Crisis" Journal of Futures Markets, forthcoming. (ABS rating: 3)

- Bae, Sung C., Hyeon Sook Kim, Taek Ho Kwon, "Foreign Currency Borrowing Surrounding the Global Financial Crisis: Evidence from Korea." Journal of Business Finance and Accounting 47 (May 2020), Issue 6, 786-817. (ABS rating: 3)

- Bae, Sung C., Taek Ho Kwon, "Do Firms Benefit from Related Party Transactions with Foreign Affiliates? Evidence from Korea." International Review of Finance 20 (September 2020), Issue 3, 639-664. (ABS rating: 3)

- Mingsheng Li, Desheng Liu, Hongfeng Peng, and Luxiu Zhang, 2020. "Does low synchronicity mean more or less informative prices?" Journal of Financial Stability, forthcoming (ABS rating: 3)

- Yugang Chen, Yu Liu, and Mingsheng Li, 2020. "Do funds selected by managers’ skill perform better?" Research in International Business and Finance, forthcoming (ABS rating: 2)

- Mingsheng Li, Desheng Liu, Hongfeng Peng, and Lvxiu Zhang, 2020. "Volatile market condition, institutional constraints, and IPO anomaly: evidence from the Chinese market", Accounting and Finance, forthcoming (ABS rating: 2)

- Francis, B., Hasan, I., Liu, L., Wu, Q., & Zhao, Y. (2021). Financial analysts’ career concerns and the cost of private debt. Journal of Corporate Finance, 67, 101868. (ABS rating: 4)

Faculty Updates on Major Activities, Achievements and Awards

- Dr. Sung Bae was recently appointed to the first Fred E. Scholl Endowed Chair in Finance and Insurance (see the press article below). He was also presented a Certificate of Appreciation from the Center for Faculty Excellence at Bowling Green State University for being recognized by BGSU students as making a difference, March 2020.

- Dr. Mingsheng Li received Robert A. Patton Scholarly Achievement Award in Fall 2020.

- Dr. Liuling Liu was appointed to the Ashel G. Bryan/Huntington Bank Professor for a three-year term in September 2020 (see Dr. Liu’s short bio below).

- Professor Roc Starks, Assistant Teaching Professor, has recently agreed to serve on the Diversity, Equity and Inclusion Committee for the Ohio Insurance Industry Resource Council (IIRC) to further create robust diversity, equity and inclusion strategies within the insurance industry in the State of Ohio. Professor Starks has also joined the Gamma Iota Sigma Faculty Roundtable and received the Marie R. Hodge Faculty Advising Award in 2019.

Dr. Liuling Liu Appointed to the Ashel G. Bryan/Huntington Bank Professor in September 2020:

Since joining BGSU in 2013, Dr. Liu has been teaching courses mainly in financial markets and financial institutions in addition to business finance. Dr. Liu is currently developing a new FinTech course. Dr. Liu has also frequently offered various non-classroom teaching, advising, or guidance to business students, including student competition cases. In spring 2017 and 2019, Dr. Liu worked as faculty advisor to prepare students for the Undergraduate Research Poster Competition at the Federal Reserve Bank of Cleveland; her students received first prize in the finance track in both years. From fall 2017 to spring 2018, Dr. Liu advised a team of three undergraduates in the 2018 CSBS Community Bank Case Competition. Our team advanced to the second round of judging.

Dr. Liu’s research focuses on banking, including topics such as bank regulation and supervision, deposit insurance, bank funding, lending, and risk management. Since joining BGSU in 2013, Dr. Liu has published sixteen refereed research articles and one book chapter, many of which were published in top banking journals such as Journal of Banking & Finance, Journal of Financial Stability, Journal of International Money and Finance, and Journal of Financial Service Research. Furthermore, two of her articles were published in the Financial Times Top 50 journal list, which is now widely adopted by leading business schools as a list of premier journals. Dr. Liu is the recipient of the Leadership Council Faculty Excellence Award in Research and the 2019 Robert A. Patton Scholarly Achievement Award in 2019.

BGSU Schmidthorst College of Business Finance Department Chair Dr. Sung Bae Appointed as Fred E. Scholl Endowed Chair in Finance and Insurance (Written by Bailey Smith, SCoB Communications Intern; article appeared in local newspaper and college web)

Dr. Sung C. Bae, Chair and Professor in the Department of Finance in the Schmidthorst College of Business at Bowling Green State University, has been appointed as the first Fred E. Scholl Endowed Chair in Finance and Insurance. Dr. Bae, who joined BGSU as an Assistant Professor of Finance in 1987 and holds a Ph.D. in Finance from the University of Florida, has held the department chairmanship from 1996-2003 and 2010 until present. As an internationally recognized scholar in the areas of international finance and risk management, Dr. Bae has published more than eighty research articles in mainstream finance journals and periodicals, and he is in the top 3% of most published finance authors. His long history of research has resulted in many awards and recognitions, including fourteen best research paper awards from professional organizations, as well as the college’s Robert A. Patton Scholastic Achievement Award five times. He has also previously held the Ashel G. Bryan/Huntington Bank Professorship. Dr. Bae has consulted with a multitude of domestic and international companies and currently serves on editorial board of eight academic journals. In addition, Dr. Bae has spearheaded the development of many programs at BGSU, including the Insurance & Risk Management, Financial Planning Concentration, CFA Concentration, and MBA Specialization in Finance programs.

“We are pleased to appoint Dr. Bae the Fred E. Scholl Endowed Chair. He is an exceptional and well-respected scholar and leader,” commented Ray Braun ’80, Dean of the Schmidthorst College of Business.

The Fred E. Scholl Charitable Foundation provided the Schmidthorst College of Business with a gift of $1 million to establish the endowed chair of finance and insurance. The Scholl Foundation, created in 1997 after the passing of Cleveland businessman Fred E. Scholl, is a private, grant-making foundation whose primary mission is to support education and human services initiatives. It has donated substantial resources to qualified charitable organizations, the most significant of which have been college scholarships.

Bernard L. Karr ’69, Chairman of the Fred E. Scholl Charitable Foundation, stated, “Education has been one of the strongest components of the Foundation. The Trustees of the Foundation believe this investment in quality business education will pay dividends, including enhancing the already outstanding reputation of the Schmidthorst College of Business, for many years to come.”

“I am extremely honored to be appointed as the first Fred E. Scholl Endowed Chair in Finance and Insurance,” shared Dr. Bae. “On behalf of the Department of Finance, I am very grateful to the Scholl Foundation, Spence Seaman and Bernie Karr for supporting our Finance and Insurance & Risk Management programs through this endowed professorship. Both of our programs have experienced significant growth over the past several years, and I am confident that the Fred E. Scholl Endowed Chair professorship will make a tremendous contribution to further the growth and recognition of BGSU’s Finance and Insurance programs. My deep appreciation also goes to Dean Ray Braun and Provost Joe Whitehead for selecting me as the first recipient of this endowed professorship.”

NEWS & ACTIVITIES

Finance and Insurance & Risk Management Advisory Board Joint Meeting

This past fall the Department was unable to hold the Annual Finance and Insurance & Risk Management Advisory Boards’ joint meeting. Below are pictures taken from the previous joint board meeting in September 2019.

Finance Advisory BoardFront row (from left): Matthew Garrow, Mark Kangas, Perry Cabean, Bruce Misamore.

Back row (from left): Peter Bahner, Jr., Brendan Foley, David Kailbourne, Dennis Adams.

Insurance and Risk Management Advisory BoardFront row (from left): Diane Keil-Hipp, Claire Nelson, Janet Gerken, Brian Bowerman, Thomas Hogan, Sarah Hercules.

Back row (from left): Peter Bahner, Sr., Connor Mutchler, Sylvia Chandler, Drew Gunn.

Donor Information

Special thanks to our donors for scholarships, gifts, and other contributions:

| Andrew and Kimberly Fichthorn | Avery Dennison Corporation | Brendan and Kimberly Foley |

| Brett Newman | Brown and Brown Insurance | Bruce and Janet Misamore |

| Charles and Deborah Lynn Schaan | Collin Reynolds | Daniel P. Klein and Linda Bowyer |

| Darwin B. Close | David Day and Jose Rodrigues | Donald L. and Suzanne Speck |

| Emery S. Gielow | Fern Harger | Fred E. Scholl Charitable Foundation |

| Finance faculty | Geoffrey & Linda Radbill | Grange Insurance |

| Huntington Bank | Hylant family foundation | Jared Poff |

| Jeffrey Born | John and Deborah Bowen | J. Warren Hall |

| Kenneth H. Harger | KeyBank of Northwest Ohio | Margaret P. Close |

| Mary Jane Little Dorais | Maryana Hall | MacArthur Plumart |

| Mark Kangas (North Star Group) | Matthew & Jane Garrow | Matt and Jennifer Wey |

| Maureen and Christopher Conroy | Maurice E. Miller, Jr. | Medical Mutual of Ohio |

| Michael G. Romanello | Michael and Julia Mitchell | Neil Roache |

| Norman Fichthorn | Ohio Farmers Insurance | Ohio Insurance Institute |

| Paramount Insurance | Peter G. & Donna L. Bahner | Prudential Insurance |

| Rachel Wingate | Raj and Kausalya Padmaraj | RIMS of Toledo |

| Robert and Laura Wolverton | Steven Rado | Thomas and Cynthia Pemberton |

| Timothy Egloff & Tracy Tester | Western & Southern Life | Westfield Insurance |

| William H. & Muriel A. Fichthorn |

Alumni News

Perry Cabean (’94, MBA), Principal and Owner, Grand Street Capital Management, L.L.C., Winston-Salem, NC

I know the COVID pandemic has been especially difficult in the higher education arena. One piece of good news is that my youngest son graduated from Michigan State University's Engineering program and is currently working for Fiat Chrysler. It was difficult through the pandemic but he made it. Our firm continues to grow as I recently added another institutional client and I am being considered for additional fundings. Also, I have been named the Director of a non-profit initiative that seeks to provide small minority-owned businesses grants to help them sustain their businesses during these difficult times. I believe press releases will take place in the near future for both endeavors. Finally, I have decided to give the CFA a go again. I have started to study for the June, 2021 Level II examination. It had been difficult in the past because of family and career responsibilities but I am going to try again. Wish me luck. Well take care.

PHOTO GALLERY

Updated: 04/07/2022 04:28PM